riverside county sales tax calculator

Santa Clara California Property Tax Calculator. Change Date Tax Jurisdiction Sales Tax Change Cities Affected.

Understanding California S Property Taxes

Click here for a larger sales tax map or here for a sales tax table.

. In other states your assessed value is thousands less than the market value. The median property tax in Fairfax County Virginia is 4543 per year for a home worth the median value of 507800. That is nearly double the.

The exact property tax levied depends on the county in New Jersey the property is located in. The county has a sales tax of 95. Riverside County has one of the highest median property taxes in the United States and is ranked 248th of the 3143 counties in order of median property taxes.

Sacramento CA Sales Tax Rate. Rates include state county and city taxes. Shelby County collects the highest property tax in Alabama levying an average of 90500 047 of median home value yearly in property taxes while Crenshaw County has the lowest property tax in the state collecting an average tax of 20600 029 of.

This is the total of state county and city sales tax rates. As an example consider Los Angeles County. West Virginia has one of the lowest median property tax rates in the United States with only two states collecting a lower median property tax than West Virginia.

Cook County has one of the highest median property taxes in the United States and is ranked 91st of the 3143 counties in order of median property taxes. Sales Tax Calculator Sales Tax Table. Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335There are a total of 125 local tax jurisdictions across the state collecting an average local tax of 2114.

Franklin County collects on average 167 of a propertys assessed fair market value as property tax. Raised from 6225 to 7225 Bixby. Fairfax County collects on average 089 of a propertys assessed fair market value as property tax.

Illinois is ranked 5th of the 50 states for property taxes as a percentage of median income. If you need access to a database of all Missouri local sales tax rates visit the sales tax data page. The Illinois sales tax rate is currently.

Fairfax County has one of the highest median property taxes in the United States and is ranked 41st of the 3143 counties in order of median property taxes. Combined with the state sales tax the highest sales tax rate in Alabama is 125 in the city of. Missouri has 1090 cities counties and special districts that collect a local sales tax in addition to the Missouri state sales taxClick any locality for a full breakdown of local property taxes or visit our Missouri sales tax calculator to lookup local rates by zip code.

Riverside CA Sales Tax Rate. The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800. Orange County California Property Tax Calculator.

The property tax rate in the county is 078. The latest sales tax rates for cities in California CA state. The County sales tax rate is.

West Virginias median income is 44940 per year so the median yearly property tax. Click here for a larger sales tax map or here for a sales tax table. The 2018 United States Supreme Court decision in South Dakota v.

Riverside County California Property Tax Calculator. Alabama has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 7There are a total of 377 local tax jurisdictions across the state collecting an average local tax of 5085. Pennsylvania has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 2There are a total of 68 local tax jurisdictions across the state collecting an average local tax of 0166.

The median property tax in Riverside County California is 2618 per year for a home worth the median value of 325300. Automating sales tax compliance can help your business keep compliant with changing sales. Combined with the state sales tax the highest sales tax rate in Pennsylvania is 8 in the cities.

Lake County collects the highest property tax in Illinois levying an average of 219 of median home value yearly in property taxes while Hardin County has. Cook County collects on average 138 of a propertys assessed fair market value as property tax. If you need access to a database of all Illinois local sales tax rates visit the sales tax data page.

The exact property tax levied depends on the county in Alabama the property is located in. Has impacted many state nexus laws and sales tax collection requirements. A county-wide sales tax rate of 175 is applicable to localities in Cook County in addition to the 625 Illinois sales tax.

Click here for a larger sales tax map or here for a sales tax table. Within the county a handful of cities charge a higher sales tax. If you need access to a database of all California local sales tax rates visit the sales tax data page.

On top of the states minimum sales tax individual counties and cities also charge a sales tax. The assessor determines this by comparing recent sales of homes similar to yours. Riverside County collects on average 08 of a propertys assessed fair market value as property tax.

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Franklin County has one of the highest median property taxes in the United States and is ranked 252nd of the 3143 counties in order of median property taxes. Dekalb County Georgia.

California has 2558 cities counties and special districts that collect a local sales tax in addition to the California state sales taxClick any locality for a full breakdown of local property taxes or visit our California sales tax calculator to lookup local rates by zip code. Hunterdon County collects the highest property tax in New Jersey levying an average of 191 of median home value yearly in property taxes while. Iron County Hospital District Hpd Sp MO.

The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year. San Bernardino CA Sales Tax Rate. New Jersey is ranked 1st of the 50 states for property taxes as a percentage of median income.

Click here for a larger sales tax map or here for a sales tax table. The minimum combined 2022 sales tax rate for Chicago Illinois is. Only about a quarter of the cities in California actually charge a sales tax of 725.

Texas has state sales tax of 625 and allows local governments to collect a local option sales tax of up to 2There are a total of 999 local tax jurisdictions across the state collecting an average local tax of 1684. Combined with the state sales tax the highest sales tax rate in Utah is 905 in the city of Park. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes.

The Clark County sales tax rate is. Illinois has 1018 cities counties and special districts that collect a local sales tax in addition to the Illinois state sales taxClick any locality for a full breakdown of local property taxes or visit our Illinois sales tax calculator to lookup local rates by zip code. The exact property tax levied depends on the county in Illinois the property is located in.

To review the rules in Nevada visit our state-by-state guide. The Chicago sales tax rate is. The median property tax in West Virginia is 46400 per year049 of a propertys assesed fair market value as property tax per year.

State Tax Rates. The median property tax in Franklin County Ohio is 2592 per year for a home worth the median value of 155300. September 2022 Sales Tax Changes - 4 changes in 3 states.

Some cities and local governments in Cook County collect additional local sales taxes which can be as high as 35. 2020 rates included for use while preparing your income tax deduction. Combined with the state sales tax the highest sales tax rate in Texas is 825 in the cities of.

Heres how Cook Countys maximum sales tax rate of 115 compares to other counties around the United.

Dupage County Residents Pay Some Of The Nation S Highest Property Tax Rates

Understanding California S Sales Tax

Transfer Tax In Riverside County California Who Pays What

Who Pays The Transfer Tax In Orange County California

Riverside County Ca Property Tax Calculator Smartasset

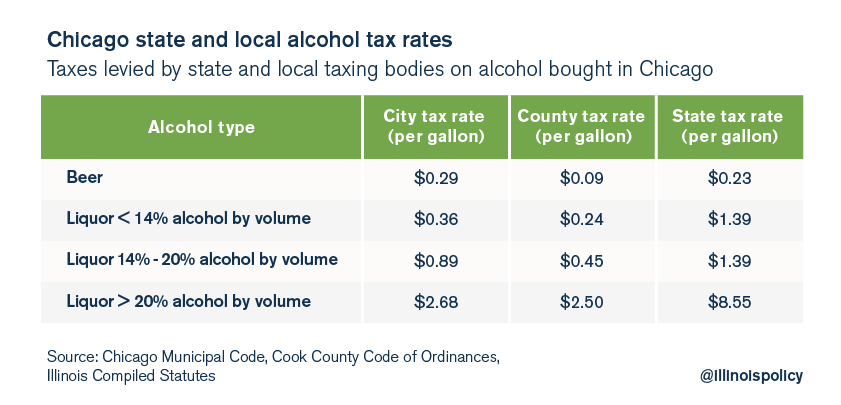

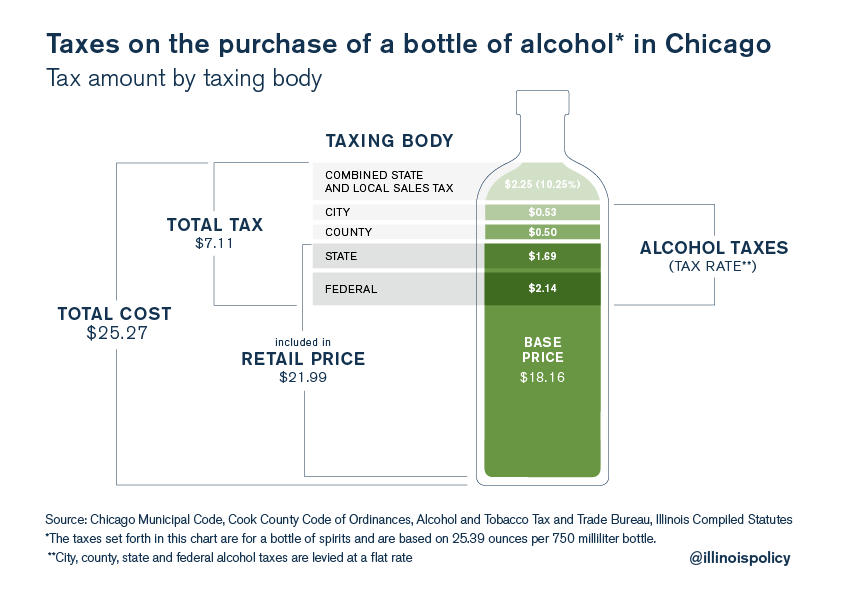

Chicago S Total Effective Tax Rate On Liquor Is 28

California Sales Tax Guide For Businesses

California Sales Tax Small Business Guide Truic

Chicago S Total Effective Tax Rate On Liquor Is 28

Understanding California S Property Taxes

California Sales Tax Rates By City County 2022

Riverside County Ca Property Tax Calculator Smartasset

The Property Tax Inheritance Exclusion

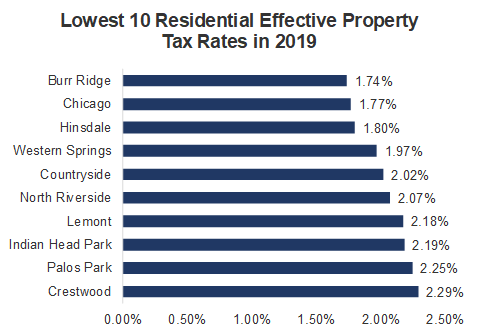

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

How To Calculate Cannabis Taxes At Your Dispensary

Food And Sales Tax 2020 In California Heather

Alentar Imitar Apertura San Antonio Sales Tax Calculator Mostrarte Humedad Hazlo Pesado